B.C. foreclosures rising as higher mortgage payments kick in

- Nor Yu

- Dec 4, 2025

- 1 min read

1. Court-ordered sales in Metro Vancouver have surged—and the renewal wave hasn’t even peaked.

Court-ordered listings have jumped from 28 → 66 → 119 over the past three years. This rise is seen as the early stages of a much larger problem as thousands of pandemic-era buyers now face renewals at drastically higher rates.

2. Higher interest rates + rising unemployment = more homeowners slipping into arrears.

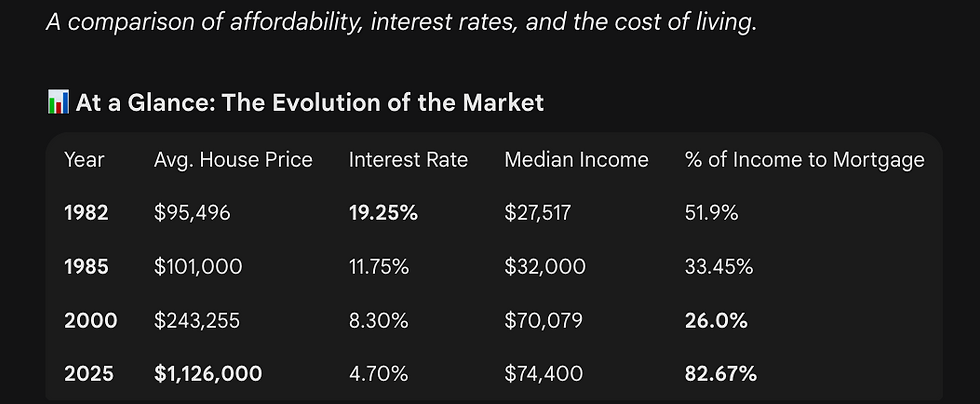

Borrowers who locked in mortgages at 1.6%–1.9% during COVID are now renewing around 3.8%+, causing severe payment shock. Mortgage delinquencies in B.C. are rising, and experts expect another 6–12 months of increasing foreclosures, since arrears are a lagging indicator.

3. Distress creates both danger and opportunity in the market.

Some foreclosures are selling 30% below market value, attracting investors. But risks remain: court-ordered sales are as-is, with no protection against damage or missing appliances. For troubled homeowners, early communication and financial planning remain critical.

If 2021 buyers begin renewing at nearly double their original interest rate over the next 12 months, how prepared is Metro Vancouver for the true scale of distress that hasn’t yet surfaced?

link:

Comments