Canada faces wave of mortgage delinquencies and arrears

- Nor Yu

- Oct 16, 2025

- 1 min read

Key Takeaways

Mortgage delinquency rising

Canada Mortgage and Housing Corporation (CMHC) reports that the rate of mortgage delinquencies has increased to 0.22 % in the latest period, up from 0.14 % previously.

This increase, though it seems small in absolute terms, signals more households having trouble keeping up with mortgage payments.. it increased by 57%

More Canadians struggling to afford mortgages

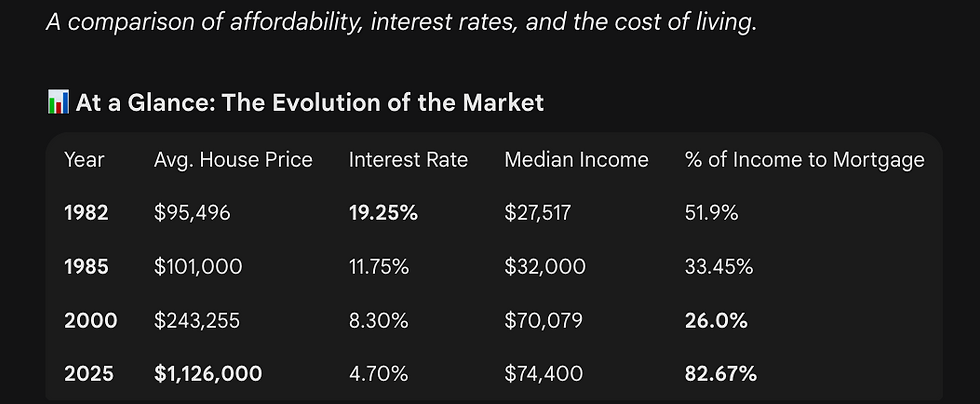

Increasing interest rates, higher debt servicing costs, and inflation are putting financial stress on homeowners.. About 60% of outstanding mortgages are set to renew in 2025 and 2026.

Some mortgage renewals will see much higher payments, causing affordability gaps for many homeowners.

Risk to housing stability / financial stress

If payments rise too sharply, some homeowners may fall behind, increasing defaults, forced sales, or foreclosures.

The rising delinquency rate, while low overall, is a warning sign that more Canadian households are vulnerable to shocks (job loss, rate jumps, unexpected expenses).

Comments